If you want to trade commodities, you need to have an idea about the main types of the traded commodities, as well as about the main risks of such type of investment. It should be taken into consideration that it is quite risky to trade commodities, if you are a beginner and do not know the market features. This type of trading requires experience and ability to analyze the behavior of the markets.

What Is Important to Know in Trading Commodities?

Commodities are divided to several main categories:

- Precious metals (gold, silver, platinum, etc.)

- Energy (oil, gas, etc.)

- Agriculture (coffee, cocoa, wheat, cotton, etc.)

Being a commodity is not yet enough to be traded in the markets. The commodity should be in circulation, that is, trades on it should be organized or it should be provided at auctions or the stock exchange should release futures contracts for the commodity and organize stock trading on these instruments. Commodities should be measured in generally accepted units - for example, oil is supplied in barrels, sugar in pounds, oats and wheat in bushels, etc. Besides releasing physically delivered futures contracts, stocks also release cash settled futures. The latter is not delivered physically, but upon the expiry of the contract cash settlement between the parties is performed.

What Are the Advantages in Trading Commodities?

- When trading, for example, stocks, many trading aspects depend on the company’s activities. If the company goes bankrupt, its shares stop existing. In case of trading commodities, you are protected from such situations. Gold, wheat or sugar will never stop existing.

- You can get profit in case of increasing and decreasing commodity prices. You can track the movement of the commodity in the market through your trading terminal. For analyzing the situation you should just open the chart of the required commodity and watch current quotations.

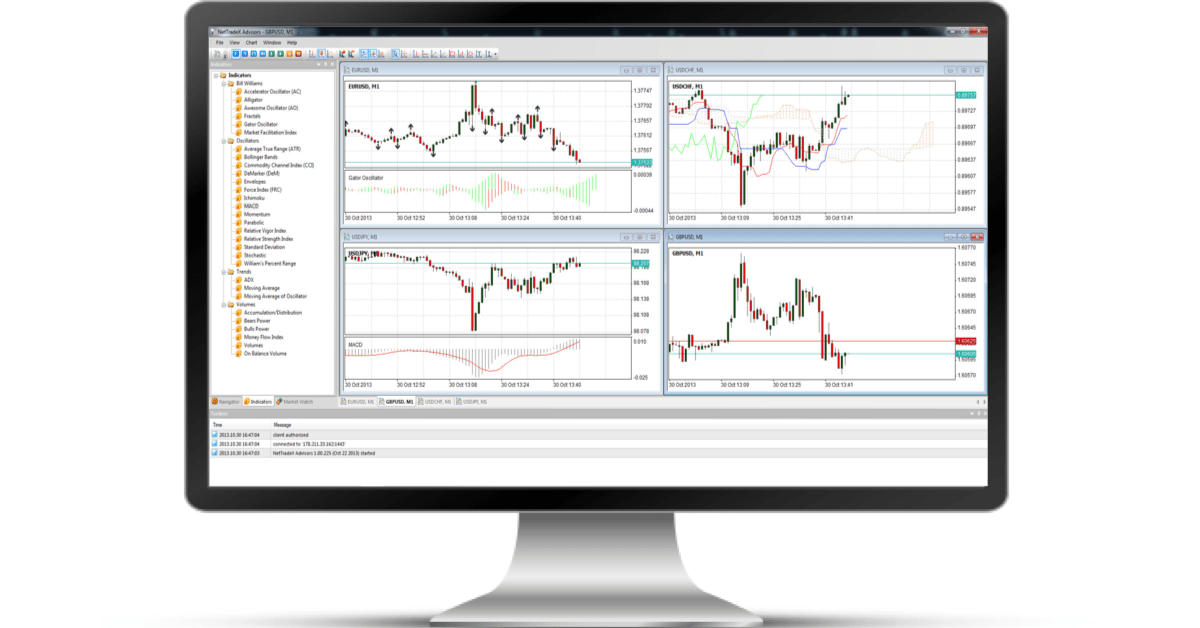

If the broker provides leverage, trader can speculate on commodity markets, investing only the margin which is a small part of the full price of the traded commodity. IFC Markets offers its clients favorable conditions for trading commodities. On NetTradeX and MetaTrader 4 trading platforms you can trade continuous CFDs on commodities and CFDs on commodity futures, speculating on price fluctuations. You do not need to pay the full price of the commodity since you will be provided with a leverage up to 1:400.

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Windows Mobile. The company also offers MetaTrader 4 and MetaTrader 5 trading platforms available on PC, Mac OS, iOS and Android. You may compare the advantages of each platform.