Once you have become enthusiastic about the opportunities of CFD (Contract for Difference) trading, your next step would be choosing a good and reliable broker CFD. The differences between CFD brokers can be great and it is of utmost importance to be well informed to choose the right one for cooperation.

The Main Function of a Broker CFD

Broker CFD is the provider of CFD trading, through which individual traders can easily trade CFDs without any contract terms. Actually, each CFD provider specifies its own conditions and has its own offers to traders; however, there can be found certain things which are common to most of them. Traders open a position for a particular instrument and when the position is closed, the difference between the opening and closings trades can result either in loss or in a profit.

Thus, this type of trading is referred as a contract between the client and the broker, where a CFD is accepted as the only tradable instrument which reflects the price fluctuations of the underlying asset. The most important factor here is that the actual underlying asset can never be owned. Traders can make a profit depending on the price movement of the underlying asset relative to the position taken.

What Should a Broker CFD Offer?

Aside from the basic advantages that CFD trading usually provides, there are certain features that CFD brokers should offer to their clients. Each favorable condition can bring forward new opportunities for profitable trade, hence, it is traders' task to pay close attention to the below mentioned features.

- Assets to be traded

- When choosing a broker CFD, it is necessary to consider what assets you are provided with. The instruments that a broker offers should be differentiated, so that traders should be able to trade with diverse financial instruments, including ETFs, indices, like S&P500, NASDAQ, DAX, NIKKEI, etc., wide range of currency pairs, commodities, like oil, wheat, copper, gold, gas, etc., and CFDs on stocks, like CFD on Amazon shares, CFD on Facebook shares, etc. The main advantage of CFDs over stock options (one of the most important equity derivatives) is their pricing simplicity and the wide range of underlying instruments.

- Along with financial derivatives IFC Markets has developed a special instrument which has the form of uninterrupted futures contract which gives investors a unique chance to trade without an expiration date. This is a great privilege as compared to the trade with dates of expiration.

- Maximum leverage

- The difference in the maximum leverage that brokers offer can be great. The size may range between 1:10 to 1:400. Surely, high leverage gives an opportunity of a huge income, but it is meanwhile very risky. The idea of margin lending, which assumes that broker CFDs lend money to their clients who wish to trade with borrowed funds, attracts most traders. Nevertheless, traders should acknowledge that investing on margin is considered highly risky since the latter amplifies investment losses.

- Learn more about What is Leverage in Trading

- Trading platform

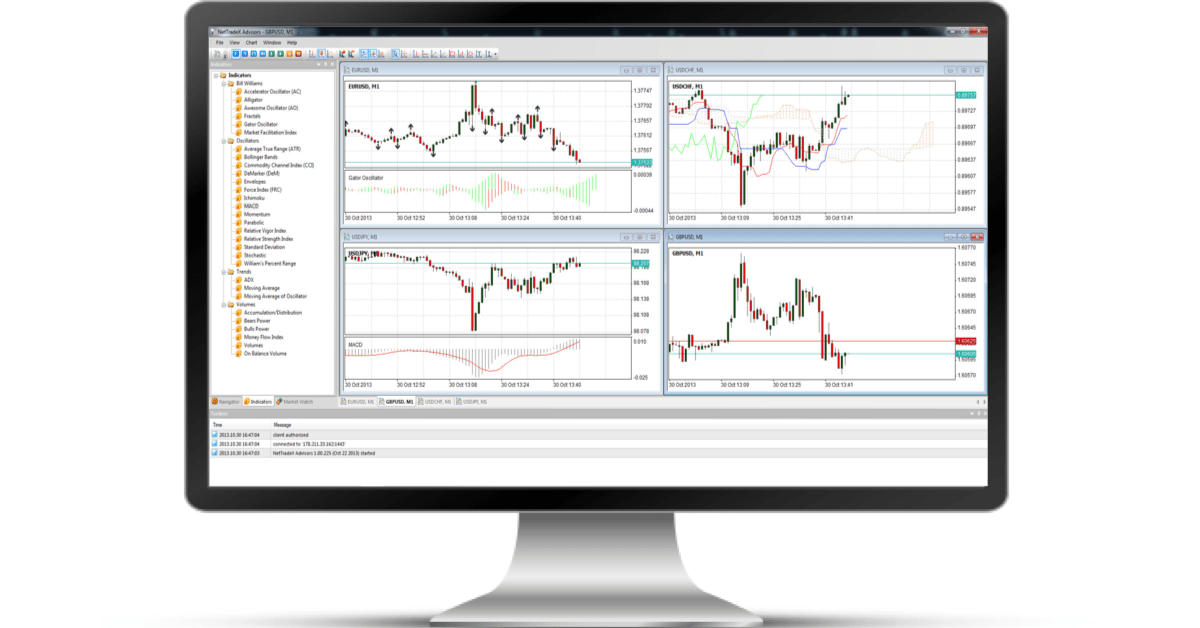

- Trading platform is one of the most important instruments through which you have a possibility to realize your trading operations. The functionality of different platforms differs in great extent. Some platforms are very easy to use, but they meanwhile lack a lot of functions. On the other hand, there are platforms that are very extensive, provide large trading opportunities, but those ones can be complicated for a novice and inexperienced trader. Herein, it is very important that your broker offers you a simple and user friendly platform with high functionality, so that you can easily perform any operation you wish.

- NetTradeX, the CFD trading platform,, offered by IFC Markets is equipped with all the necessary features that would provide traders' beneficial trading. On the platform you can find wide variety of trading instruments (currency pairs, stocks, commodities and indices), set complex orders (Pending, OCO, Linked and Stop Loss Order) make a withdrawal request directly from the platform, get detailed technical analysis and the latest news feed from Thomson Reuters, have access to various technical indicators and, eventually, make use of the revolutionary new method of portfolio trading, GeWorko Method, which is a completely new way and a new approach to portfolio investment and analysis.

- Spread

- As each trader knows, spread is the difference between the bid and ask prices, which is defined by broker CFD. Since spread is about the cost of trading, it is worth to carefully scrutinize what different brokers offer you and compare the conditions.

- IFC Markets offers its clients fixed spread, which is considered the most popular and accepted one. As the name implies, it does not change based on time and market changes, so that the high volatility of the market cannot have an impact on the difference between the buy and sale prices.

Each factor and each condition offered by the broker CFD can have an enormous effect on your trade. Therefore, it is more than important to properly compare and estimate the conditions you are offered. Note that your carelessness may result in irretrievable losses.