CFDs were developed in the early 1990s in the UK. CFDs enable hedge fund clients to open short positions and benefit from leverage and stamp duty exemptions. Since their introduction, the global interest and demand for CFD has been growing quickly. Nowadays online CFDs are one of the fastest growing trading instruments for all traders and all types of trading. The price of online CFD is tied to the price of the base asset; however, the asset is not being transferred from hand to hand, which allows traders to speculate on price fluctuations of the base asset without the transfer of its ownership right.

What are Online CFDs?

Contract of difference or CFD is based on an agreement between seller and buyer regarding the price difference for a particular instrument (base asset) in a specific period (from the moment of opening a CFD position to the moment of its closure) is the basis for profit/loss of the parties. If the price of underlying asset rises, seller pays to the buyer, and vice versa. CFDs can have various underlying assets, such as indices, stocks, commodities and others. A CFD position can stay for any time, during which a trader can get maximum profit of the market movements.

What are the Advantages of Online CFDs?

Investing in financial instruments through online CFD trading offer similar profit and loss opportunities, as trading in the traditional manner. However, CFDs have certain advantages:

- Online CFDs give access to various global markets from one account.

- CFDs can be used to speculate and make profit on upward as well as downward price movements.

- CFDs do not imply physical ownership of the underlying instrument, so the trader does not have to pay the associated costs, related to the purchase of the asset (for example, payment for account management fees and depositary services) .

- CFDs can be traded with leverage. This means that the trader can increase the profit from his investments. However, it is important to remember that the leverage will increase the risks to lose. Traders can effectively manage that risk by using stop loss or take profit orders and other tools as well. Learn more about What is Leverage in Trading

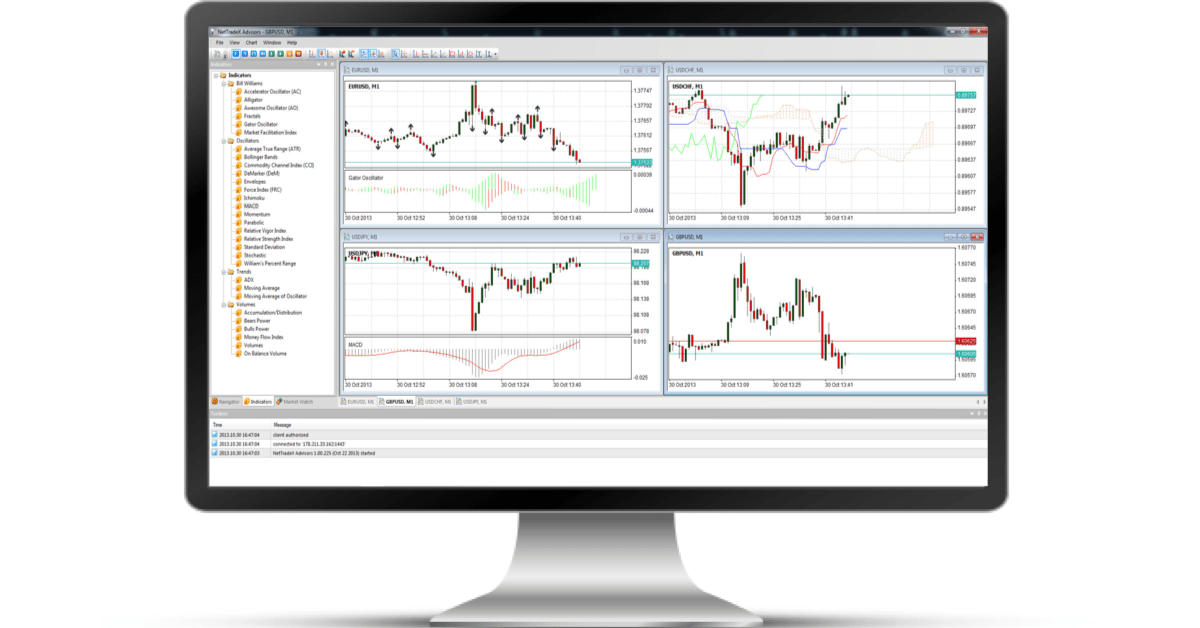

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Windows Mobile. The company also offers MetaTrader 4 platform available on PC, Mac OS, iOS, Android, Windows Mobile and Smartphone. You may compare the advantages of both platforms.