Market Update, May 20

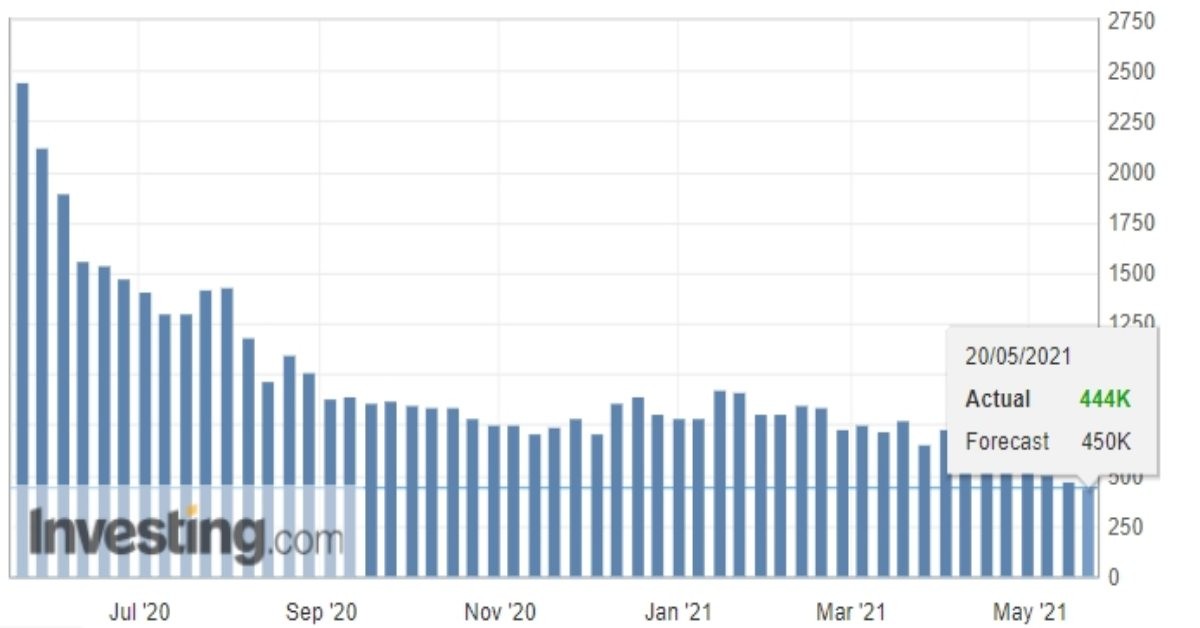

US weekly initial jobless claims fall more than expected. According to US labor data, the number of the workforce filing initial claims for jobless benefits fell to 444,000, from a total of 478,000 of week ago. This new record low of initial claims shows that economic recovery is steady, and the labor market takes advantage of reopenings.

On the other hand, continuing claims that are measuring with one week delay to initial claims rose by 100K, increased from 3.64 million (revised from 3.66 million) to 3.357 million. However, Labor Department says that total unemployment claims are decreasing. Based on Labor Department data, this number fell by almost 900K to 15.975M for the week ending May 1.

Actually, it is not that bright number, as we have almost 16 million unemployed, which will bring enormous pressure on the economy and support the FOMC member's idea of holding the monetary stimulus until the labor market can see "substantial progress." When we review the latest published numbers, we can clearly see that improvement is getting slower in the past weeks. Many believe that required different skills by employers can run slower the hirings, as many jobs already have been changed through the pandemic.

Besides employment numbers, today we also had the Philly Fed Index, which fell way much than expectations to 31.5 versus 40.8 forecasts and 50.2 last time. Employment and Philadelphia Fed Manufacturing Index, creating an uncertain situation to hold the market risk at the current level.

Market reactions:

Greenback kept its downtrend with 0.35% more lose today as well to trade at 89.85, Overal positive sentiment in the market, which helps the dow jones to raise 234.44 points (0.69%), S&P 500 to gain 41.13 points or 1% and Nasdaq to gain 1.6% or 212.16 points, pushed more pressure on the USD index and lowering the dollar Safe-Haven demand. Also, after today's data, the US 10-year treasury yields decreased to 1.639%, and it is also another measure that can hold the pressure on the US dollar.

SP500: H4 chart shows that we are at a significant level. As breaching under 4,150 sent the index to lower numbers, breathing above this level, which is the second resistance, will first put the third resistance of 4,200 in the spotlight. $4,200 also is a psychological level, and above this number market, overall sentiment will be much more positive.

EURUSD: Technical pairing moves at a clear uptrend, especially with trading above key level of 1.2170. RSI at 60 and above OBV trend line also supporting the current trend. For EURUSD, basic levels are:

Pivot point: 1.2192

Resistance levels: 1.2226 / 1.2278 / 1.2310

Support levels: 1.2142 / 1.2107 / 1.2055