Traders use Forex charts for tracking the prices of the currency pairs. Analysis of Forex charts help traders to determine the best time to buy or sell the currency. Both real-time and historical Forex data can be displayed on the chart and they are equally important as analysis of these data help traders to predict the future trends of the financial asset.

Forex Chart Overview

The total daily turnover in Forex market is very high. As Forex market is the most active and liquid market, there are a lot of data that need to be examined. For this purposes Forex traders need to visualize data by using analytical tools like Forex charts. The Forex chart is a visual interpretation of prices of the financial instruments that makes easier to recognize patterns and trends. Analyzing Forex charts, traders find the best time to sell or buy a certain currency. Traders analyze Forex charts using technical analysis tools. Forex charts evaluation is the key technique used by traders to make predictions in Forex market. Forex charts allow Forex traders to monitor currency price movements in real time.

Forex charts can have different forms, but they all have some common features. Data dimensions are often displayed on axes. Each axe has a scale, accompanied by numerical or categorical indications. Forex chart data can appear in all formats and even can include some textual labels describing the datum. The data can be in dots or shapes and unconnected or connected.

Forex Chart Types

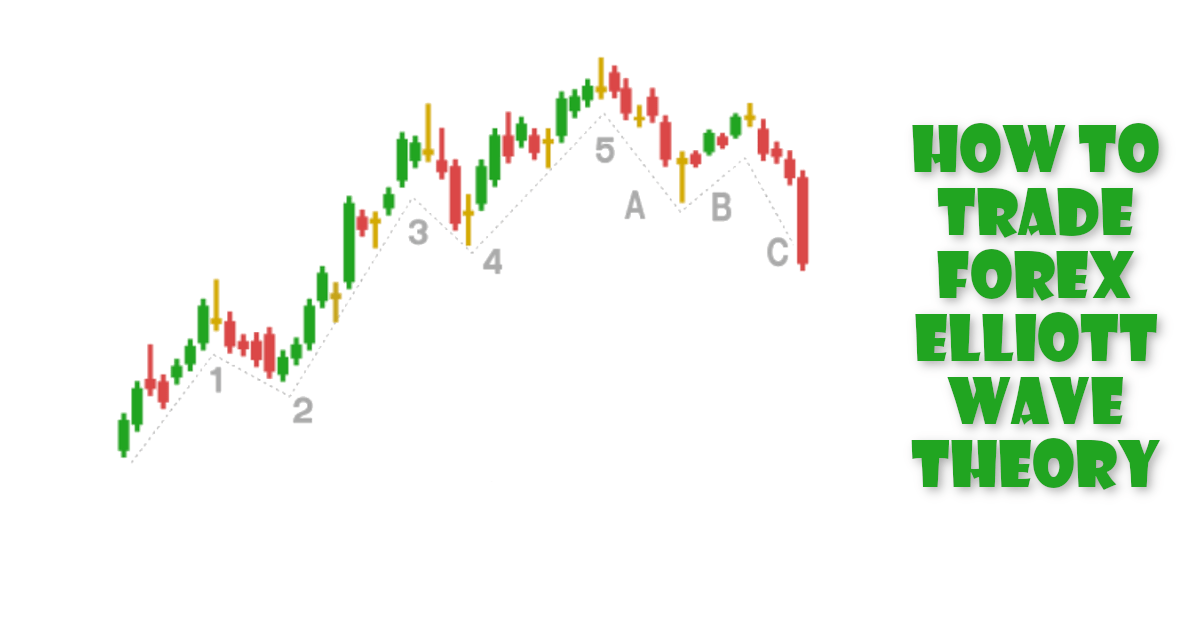

Different types of Forex charts, as well as different timeframes can be used. There are many types of Forex charts available, such as bars, candles and lines. Each type of Forex chart has its own pros and cons and provides a unique way of look at the Forex market. The most popular Forex chart type is Japanese candle, as it makes easier to see price movements, by using color – coded movements. One candle in Forex chart represents the chosen timeframe. Different timeframes, such as daily, hourly or minute, can be used for each kind of Forex chart.

One of the most popular types of charts are line charts. To plot a line chart closing prices for selected timeframe are connected by a line. This charts are helpful for looking through data for short and long periods. The only disadvantage of this chart is that it cannot represent price gaps.

The other popular Forex chart is the bar chart. This chart can be useful to display price gaps and price range over the selected period. Disadvantage of this chart is its incapacity to plot the whole price fluctuation.

Candlestick chart is also a popular Forex chart. This chart is similar to bar chart, but is easier to view. Usually in this chart if the opening price is higher than the closing the body of the bar is red (or black). In case of the opposite, the body is green (or white).

It is important to choose Forex chart type which will be appropriate to the analysis needed.

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Windows Mobile. The company also offers MetaTrader 4 platform available on PC, Mac OS, iOS and Android. You may compare the advantages of both platforms.