Currency charts are to identify historical and live trends of currency pairs. Currency charts are used by Forex traders to find out the best time to open or close positions. In fact, online currency trading would be quite difficult without currency charts, since it provides current instrument prices and only through it traders can conduct technical analysis. Thus, to have success in Forex trading, traders need to be proficient in reading and understanding currency charts and be able to develop chart trading strategy.

Currency Charts: Explained

Currency charts can be formed on various time frames and display prices in various ways. Due to these charts it becomes possible to analyze currency prices for a short time as well as for a long period and trade. In currency charts prices can be displayed as candlesticks, lines, or bars. Each of these chart types has its own advantages and disadvantages. Traders can combine them to analyze the market or choose the one that will match their trading strategy.

How to Read Forex Charts?

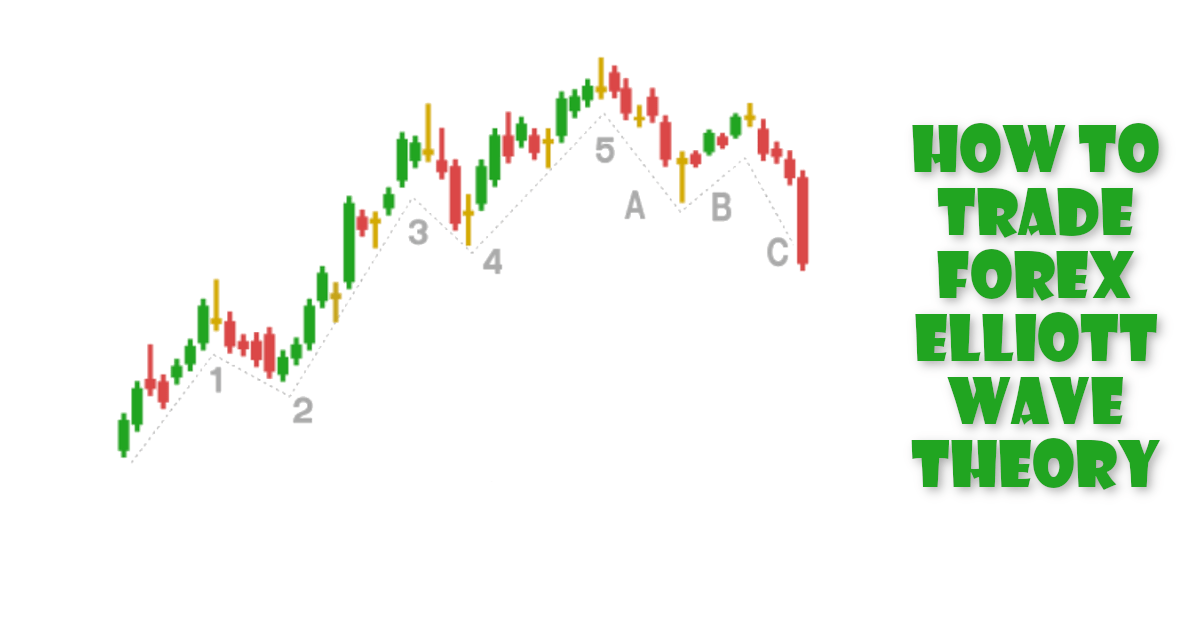

The best way to understand currency charts is to use them in practice. First of all it is important to determine the overall picture of the market trend: it can be up or down. Not clear market trend means that it is in a trading range. After determining the trend, it should be checked if the chart with a short timeframe confirms the trend.

In currency charts there are two trends that can be considered: minor trend and the major trend. Minor trend usually lasts for a short time and the major trend - vice versa. Then after detecting trend movements traders can choose what trend to follow or not. After analyzing data by using currency charts, traders can find out the best time to enter the market.

IFC Markets offers NetTradeX, MetaTrader 4 and MetaTrader 5 trading platforms. On NetTradeX terminal traders can take advantage of using some chart features that MetaTrader 4 and MetaTrader 5 does not support. For instance, on NetTradeX there are percentage charts. The user has an opportunity to display the dynamics of the change of several (up to 10) financial instruments on one chart. The dynamics of each instrument is calculated in percent of the price change from the initial moment over time (common to all instruments of this chart). Thus, all curves of this chart require only one percentage scale. In addition, the terminal supports synchronous review of charts that is for simultaneous review of the chart history on several windows (with various financial instruments and time frames).

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Windows Mobile. The company also offers MetaTrader 4 and MetaTrader 5 platforms available on PC, Mac OS, iOS and Android. You may compare the advantages of each platform.