Commodities trading is well known to most traders and investors; however, not all of them trade commodities, being afraid of the high risk. Nevertheless, where some people see fear, others see an opportunity.

What Is Commodities Trading?

Commodities trading is a complex of buying/selling transactions of commodities on the trading platforms (in general on the commodity exchanges). The list of the exchanges usually includes commodities of a standardized quality which are produced in large quantities. There are various groups of such commodities, including food products, products for industrial and manufacturing purposes and others. Food products include wheat, corn, frozen meat, orange juice, coffee beans, etc. The group of energetic commodities include copper, nickel, aluminum, etc.

While deciding to invest in commodities traders take into consideration the features of purchase and possession of these commodities, for example, whether it can be purchased in large quantities or not. Crude oil is one of the most traded commodities, since heating oil and unleaded gas are produced from it and are also classified as separate commodities.

Commodities trading has a lot of similarities with stock trading. Besides the key difference of what is traded, the other important difference is that in commodity trading risk is higher. Though commodities are considered more stable than other trading instruments, there is always a risk that natural disasters, political issues and changes in consumer tastes may negatively affect the value of the given commodity. Therefore, investors always should consider the relationship between supply and demand and economic and political factors.

Any factor that may limit the supply of a certain commodity may cause greater demand. As a result, the price of the commodity will quickly rise and the trader who has already bought the given commodity will have a great chance to earn a substantial return. In the same way, if the commodity has high supply and low demand there will be a price decrease.

Commodities Trading with IFC Markets

Numerous CFD brokers offer their clients commodities trading, however, conditions provided by IFC Markets are exceptional and are not offered by any other company.

IFC Markets has developed synthetic CFDs on futures that can be traded without taking into consideration expiration dates. This factor is of vital importance for traders. It is well known that usually Futures have an expiration date, the day when the futures expire (all contracts automatically are closed and mutual settlement between the parties is performed). This feature does not let traders to realize their long term strategies with comfort: they have to close current contract and open a position with a new contract. In contrast, synthetic CFDs on futures, traded without dates of expiration, allow traders to realize long term trading without inevitable losses on reopening of the positions.

Though commodities trading is rewarding, it is also a bit frustrating because of the market volatility. It requires deep knowledge of markets of the specific commodity, supply/demand ratio, the current situation on the related markets.

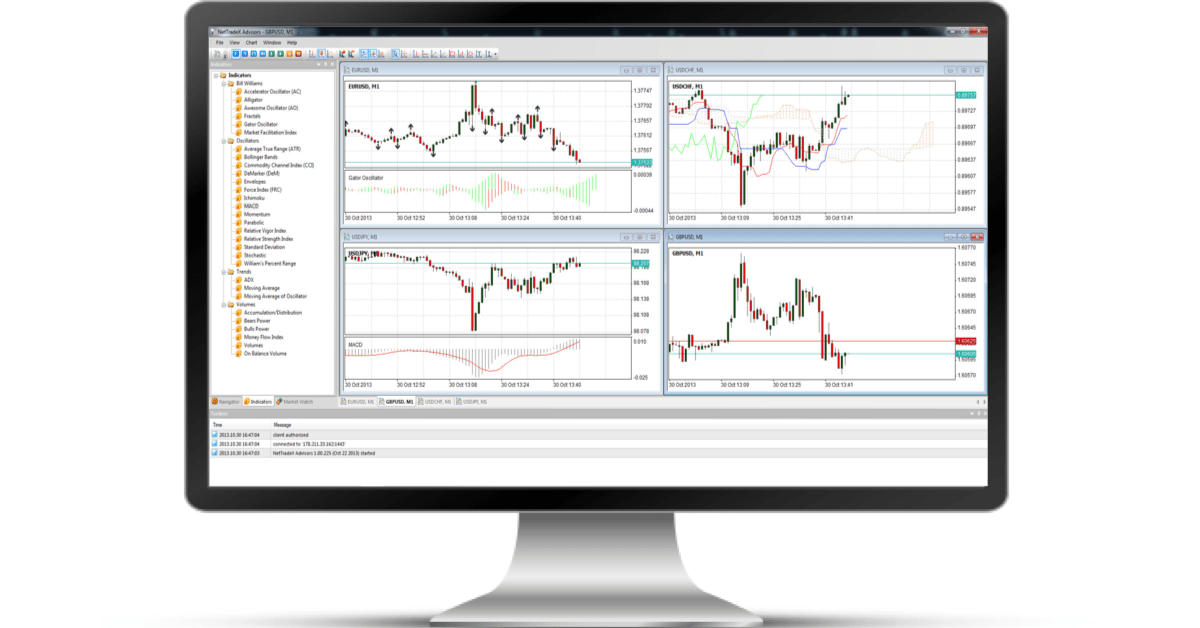

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with CFD and Forex trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Windows Mobile. The company also offers MetaTrader 4 platform available on PC, Mac OS, iOS, Android, Windows Mobile and Smartphone. You may compare the advantages of both platforms.