Trading in a CFD market implies using trading strategies based on the indicators, chart patterns, trading systems that have certain rules. Trading systems may be classified under various groups depending from the relation towards trend, timeframe for analysis, level of risk and many more. In fact, there are no specific CFD trading systems, since all trading systems may be applied to both Forex and CFD markets.

The Importance of CFD Trading Systems during Trading

CFD trading systems are referred to a set of regulations and parameters under which the trader is going to trade. Without any system CFD trading will turn into a mess, maximizing losses. There are a lot of systems that are used when trading and we will try to introduce some of them to your attention.

In fact, trading systems answer to such questions as what takes place in the market and what it should be done at a certain moment. One of such a system is trading by chart patterns, signaling the end of a trend or its continuation. Another trading systems is trading the news. Traders using this strategy need to pay attention to the released news that have a direct impact on trading and also may serve as a signal for opening a certain position.

As mentioned above, trading systems may be classified based on timeframe for analysis. For instance, there are short term, long term and intraday trading systems. The latter system is used by traders who rarely hold their positions open overnight. In addition, there is a position trading, which implies that positions may be hold for a very long time.

Trading systems are quite important for traders, since they make the trading process more monitored. Using several trading systems, however, may give no results at all, since they may contradict each other. That is why traders mostly prefer to use a certain trading system and follow it especially if they see that they are experiencing a good result.

The Effectiveness of CFD Trading Systems

Trading systems give the trading process more systematic, since it reduces the risks. The effective trading systems identify entry and exit points, showing where a stop loss should be and where the position is to be closed. An effective trading system should take into account various factors that are important for an effective trading.

CFD trading has become very popular among traders, since they can trade various financial instruments, such as indices, stocks and commodities. Trading these instruments without a trading system may result in high losses, since unsystematic trading increases the level of risk.

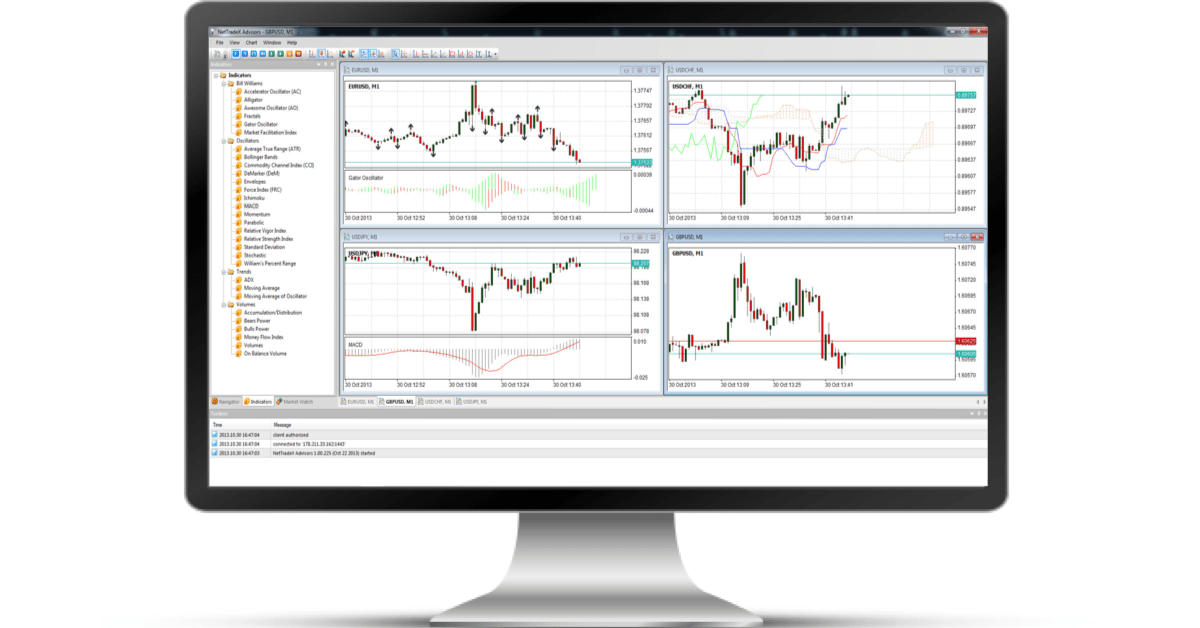

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Windows Mobile. The company also offers MetaTrader 4 platform available on PC, Mac OS, iOS and Android. You may compare the advantages of both platforms.