Trading in financial markets through contract for difference (CFD) attracts a steadily growing number of traders from all over the world. CFD is an agreement between two parties, usually “buyer” and “seller”, the value of which is based on a certain asset (for example, indices, stocks or commodity futures). At the end of the contract or at the time the parties decide to close the position, the seller pays to the buyer the difference between the current price and the opening price, if the price has increased and, vice versa, if the price of the asset has decreased, the difference between the current and initial price of the contract is negative, the buyer pays to the seller.

CFD Market as a Term

Sometimes “CFD market” term is used among traders, which is obviously incorrect, as CFD is a special trading scheme on any segment of financial market, and not a separate market. CFDs allow trading on price fluctuations of the assets, without owning the given asset, not possessing the ownership rights. Currently hundreds of brokers offer CFD trading, but one should be very careful when choosing such broker.

How to Choose a Forex Broker in "CFD Market"?

Since CFD trading is considered to be very profitable, the growing interest towards such instruments has resulted in the appearance of a large number of brokers, providing CFD trading services. While choosing a broker for CFD trading you should consider the following important features of the offered services.

- Reliability of the broker: When choosing a broker, you should analyze its activity and take into consideration such factors as the duration of its operation, feedbacks of the customers about the company. It will help you to make an opinion about the reliability of the company.

- Spread (the difference between buy and sell prices) of trading instruments: You need to find out what type of spread is provided by the broker: fixed or floating? This is important to match it with your trading aims and strategies.

- List of offered CFDs: You should choose the broker which offers a wide range of CFDs, for example, CFDs on stocks, commodities and indices. The wide choice of CFDs will provide you with greater number of trading opportunities.

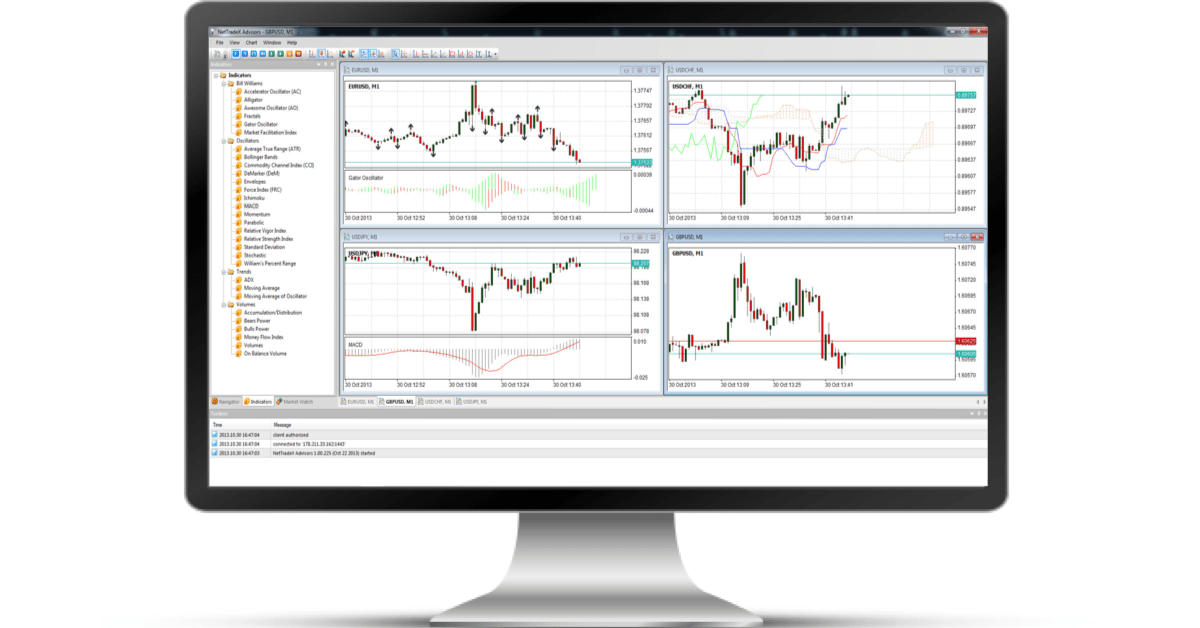

- Trading platform: The choice of trading platforms is important as a good trading platform, including convenient interface and an opportunity to set various orders will increase the effectiveness of your trading and will decrease your risks. You should study the provided platform attentively, opening a demo account. Only after the trial you can make sure whether it corresponds to your requirements or not.

- Technical support: It should be at high level which will allow you getting the required information and highly qualified consultancy instantly. It is easy to check the quality of the support service. You just need to ask a question through the live chat and make sure the answer is competent.

- Instruments for risk management: When opening CFD positions the investor should pay attention that the opened position can be both profitable and risky at the same time. There are several tools for managing the risks, one of which is Stop Loss order. It is set linked to the opened position and in case of unfavorable developments (the price moves opposite to your forecasts) the position will be automatically closed as long as the set price is achieved.

- Constant control over the margin level: It is important to limit the volume of your opened positions so as the real value of your leverage does not exceed the level set by you beforehand. The value of your leverage, generally, defines the level of your risks.

- Diversification of your investments: Try to open positions simultaneously on several financial instruments in the framework of your investment strategies, but, surely, not more than the summed volume of the positions, set by you earlier.

Besides the above mentioned, study articles, books and other materials about the market, participate in the seminars and webinars – all this will give you basic knowledge about the market. Obtaining the necessary knowledge and training is the shortest way to success. It is not important whether you are an experienced investor or a beginner in financial markets, it is important to think well before making a decision to trade. “CFD market” is popular and profitable, but is quite serious and risky at the same time. Before starting to trade CFDs you should get serious knowledge in this area.

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Windows Mobile. The company also offers MetaTrader 4 platform available on PC, Mac OS, iOS and Android. You may compare the advantages of both platforms.