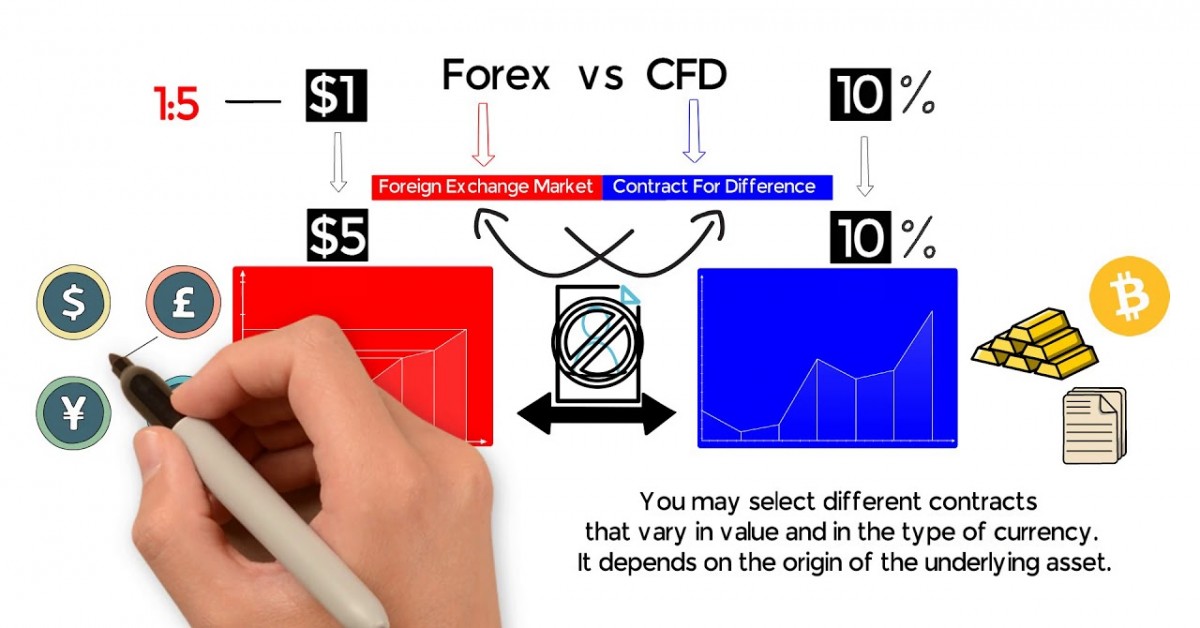

CFD and Forex are two different concepts and they should be clearly distinguished from each other. CFD is a type of a financial instrument, while Forex is a segment of financial market.

What Is a CFD?

CFD is a contract for price difference of the base asset (the underlying instrument), traded on the financial market. When entering into such a contract, one party undertakes to pay to the other party the difference between the current value of the asset and its value at the closing of the contract or at its expiration date. At the same time the contract does not assume the transfer of ownership of the underlying asset itself.

CFD was originated in 1980s in Great Britain. At those times, they were concluded only for price difference of stocks. Today, such contracts are concluded nearly for all trading instruments.

Before appearance of CFD only participants with large capital could trade instruments on international exchanges (for example, Equity and Commodity), as the cost of the deals on the Stock Exchanges equals to hundreds of thousands of dollars. CFD trading opened access to trading Stock Exchange instruments for a wide number of individuals with completely different levels of capital. For concluding such contracts it is enough to have only $100 on the account.

What Is Forex?

Forex is an international financial market, where exchange of currencies takes place. It was established in 1976, when all countries of the world refused ''golden standards'' and shifted to the system of Jamaica, assuming free currency exchange.

Forex became simply a need for normal functioning of the world economy and provision of the overflow of capitals between various countries.

Sometimes, traders call Currency Exchange market. However, this is not right. Forex is an international over-the-counter market. It does not have a certain place, where trading operations take place that in its turn allows traders making currency trading operations from any part of the world. Forex is used by the participants for exchanging currencies, but many people make high profits from such exchange. By speculative trading, they gain profit from the currency rate difference. It becomes possible due to constant and often fluctuations of the currency rates.

IFC Markets provides full spectrum of services for operating in financial markets. Clients of the company have an opportunity to trade both in Forex and CFD markets from a single account.

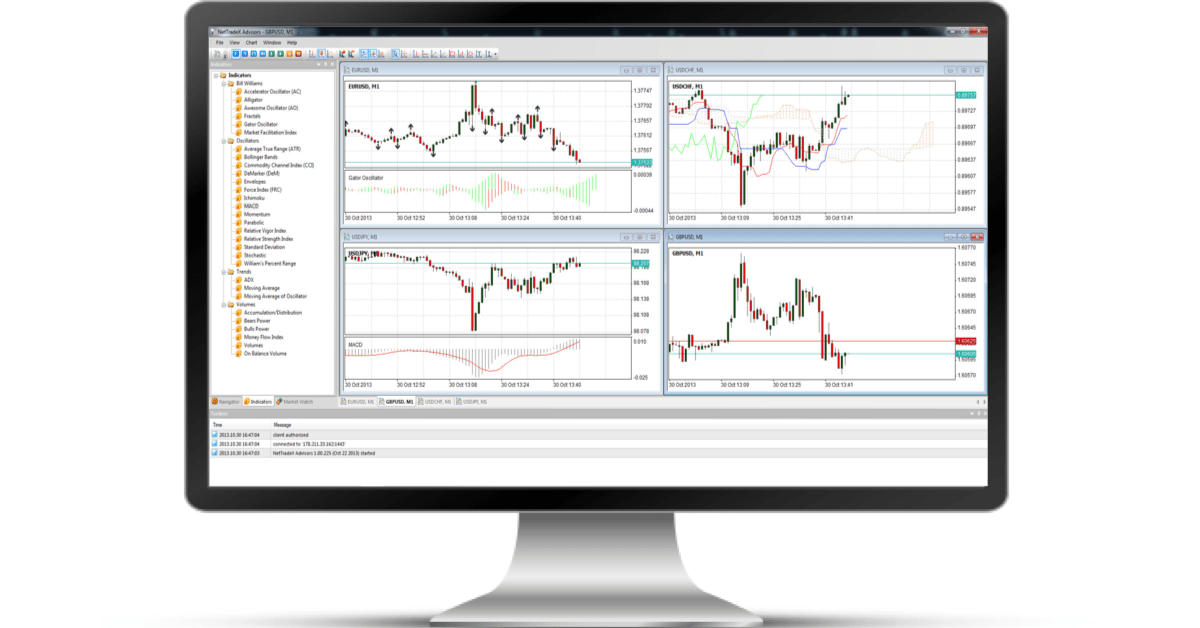

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Mobile. The company also offers MT4 platform available on PC, Mac OS, iOS, Android, Mobile and Smartphone. For comparison of the platforms, you can observe the advantages of both.