USD and Stock market review!

After increasing to new record highs in the late trading the previous day, today we are witnessing a decline in the future markets. Dow Jones futures were down 356 points, or 1.0%, while S&P 500 futures were down 0.77% and Nasdaq 100 futures were down 1%, while DJI and SP500 both closed in new records high.

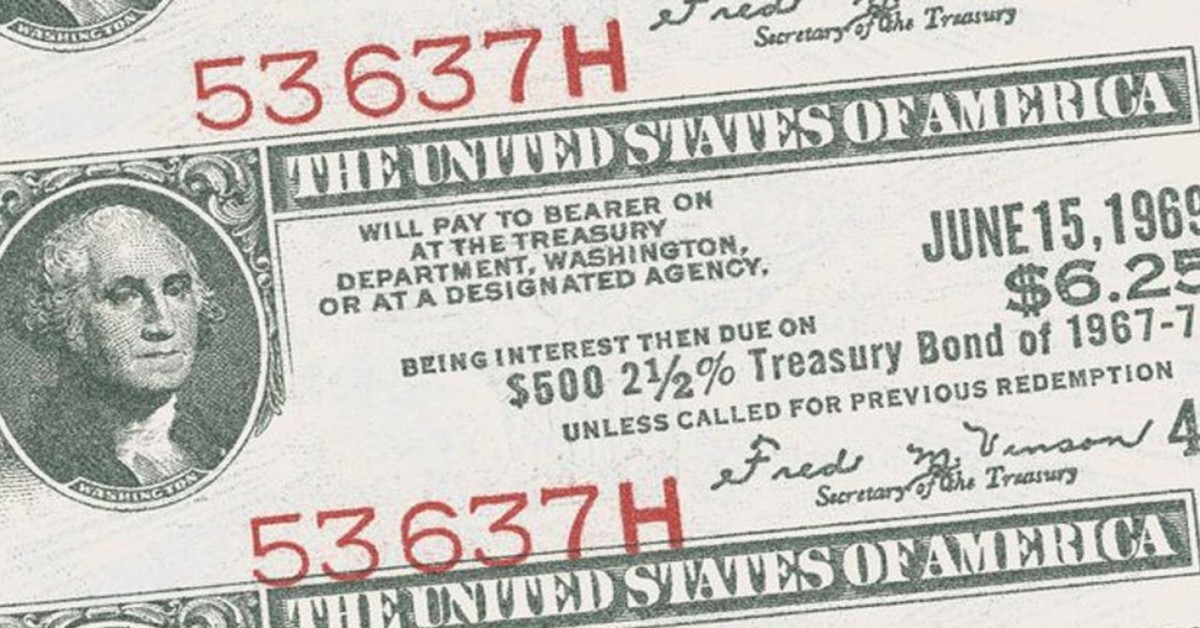

We are seeing a decline in these stock markets by decreasing the 10-year Bond Yields to 1.23% earlier today, after testing above 1.35% last week.

After weaker than expected retail sales and industrial production in China on Monday, today we saw a decrease in the US retail sales, both in headline and Core Retail Sales. These weak data tell us that economic recovery is facing some difficulties, and they move more investors into the safety of government bonds.

With increasing investors' purchases, FED will probably start tapering the asset purchasing, so they can again balance the market; by Treasury Department reducing the issuance in November, we can ensure more about market stabilization.

On the other hand, geopolitical changes in the Middle East, especially in Afghanistan, caused divisions among the major parties in the United States, and it usually increases the market risk. We could see the market reaction in the past two days.

As a reaction, the US Dollar index gained in the FX market following its safe-haven demand increasing. Currently, the index is moving above the 93-mark, with RSI at 69 and increasing the OBV trend line. Technical indicators remain in the bullish mood, which started from yesterday, after Friday's free-fall. The next resistance will be 93.18, and breathing above this level will put the 93.43 (July High).