Foreign Exchange market or Forex, as it is often referred to, is one of the largest and the most liquid financial markets across the world, with an average daily turnover of $5 trillion. Neglecting the factor of time zone and geography, Foreign Exchange market, which is defined as an international currency market, keeps on being one of the most appealing markets, where the number of participants increases rapidly. The main asset of trading in Foreign Exchange market is considered to be the currency and it’s worth mentioning that in Forex market all the currencies are traded in pairs (EUR/USD, GBP/USD, USD/JPY, etc.), where the first currency is usually known as the base currency and the second one as the quote currency. Now let us find out why traders and investors prefer to trade currencies.

Benefits of Forex Trading

In today’s rapidly developing world currency trading is supposed to be one of the best and the most efficient ways of generating profit. The main reason of the growing interest in Forex market is closely connected to the financial independence which each trader and investor can gain from the moment of entering the boundless world of finance and starting trading currencies of various countries. Foreign Exchange market offers the following advantages to the participants of the market:

- Liquidity

The existence of high liquidity makes Forex even more attractive, because it provides traders and investors with the opportunity of trading currencies with any volume.

- Availability

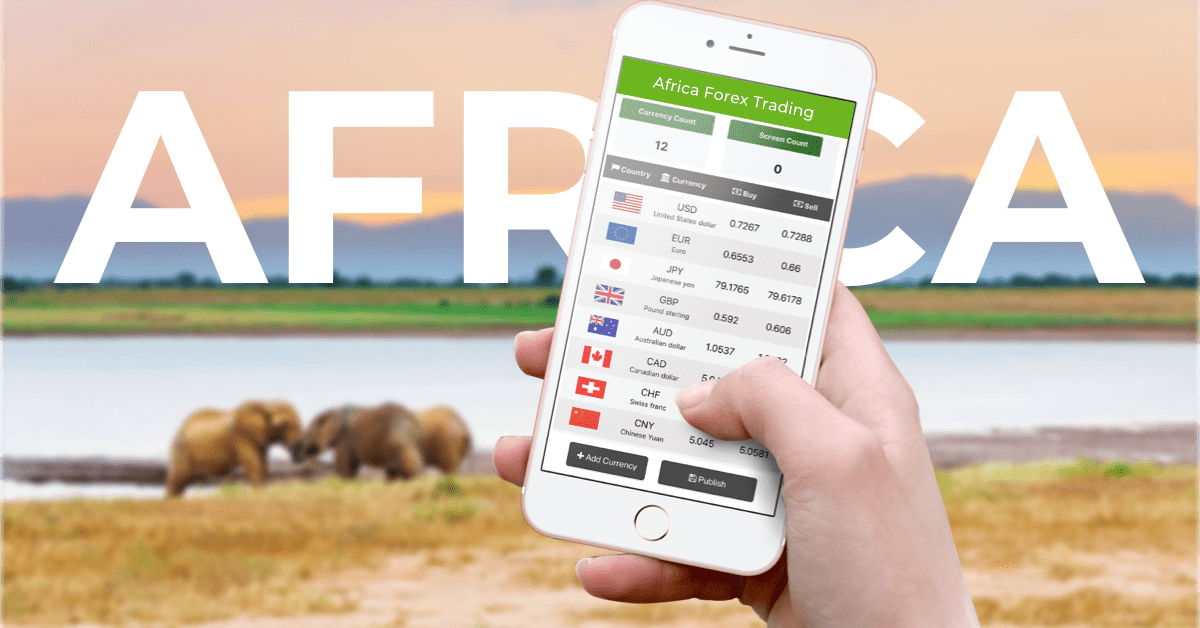

Since Foreign Exchange market is available 24 hours a day, the access to the market is possible at any time and traders can easily choose the hours which best correspond to their trading needs and demands. Now, with the emergence of the Internet connection, anyone can enter Forex market and trade currencies anytime and from any part of the world. Note that Forex market is closed at the weekends, so it is highly advisable to manage trading until Friday.

- Leverage

Another important feature of Forex market is the possibility of using leverage in trading. The leverage, provided by a broker, enables traders and investors to trade with greater volumes. This means that even with a small amount of money, in case of using leverage, traders can make profit from a large position in the market.

- Costs

The currencies are sold at the Bid price and bought at the Ask price. The difference between the Bid and the Ask prices is known as spread and the spread in its turn differs depending on the currency pair. The currencies which are traded less frequently have a greater spread and the currencies which are traded the most (major currencies) have a quite low spread. Actually, any trader or investor prefers trading currencies with low spreads, because it can affect the outcome of trading.

Trade currencies with IFC Markets

IFC Markets, a leading Forex and CFD broker, provides the best conditions in the market for making your currency trading even more agreeable and what the most important is profitable. IFC Markets offers its customers the most popular currency pairs including major, minor and exotic ones. The company is continuing to increase the number of the instruments to meet all traders’ expectations and needs. Besides being able to trade the traditional currency pairs, IFC Markets gives the unique opportunity of trading synthetic pairs created by the PCI (Personal Composite Instrument) technology. The leverage offered for currency pairs is up to 1:400 and the spread type offered is fixed. Through the analytical trading platform NetTradeX developed by IFC Markets, your currency trading will be even more convenient and enjoyable in terms of user-friendly interface.