Data breakdown and expectations.

We had the most important data of the week that, have been waiting for that all week. For the importance of this data have to remember that Chair Jerome Powell after last month’s monetary policy meeting said: “a reasonably good employment report” for September would be needed to start tapering.

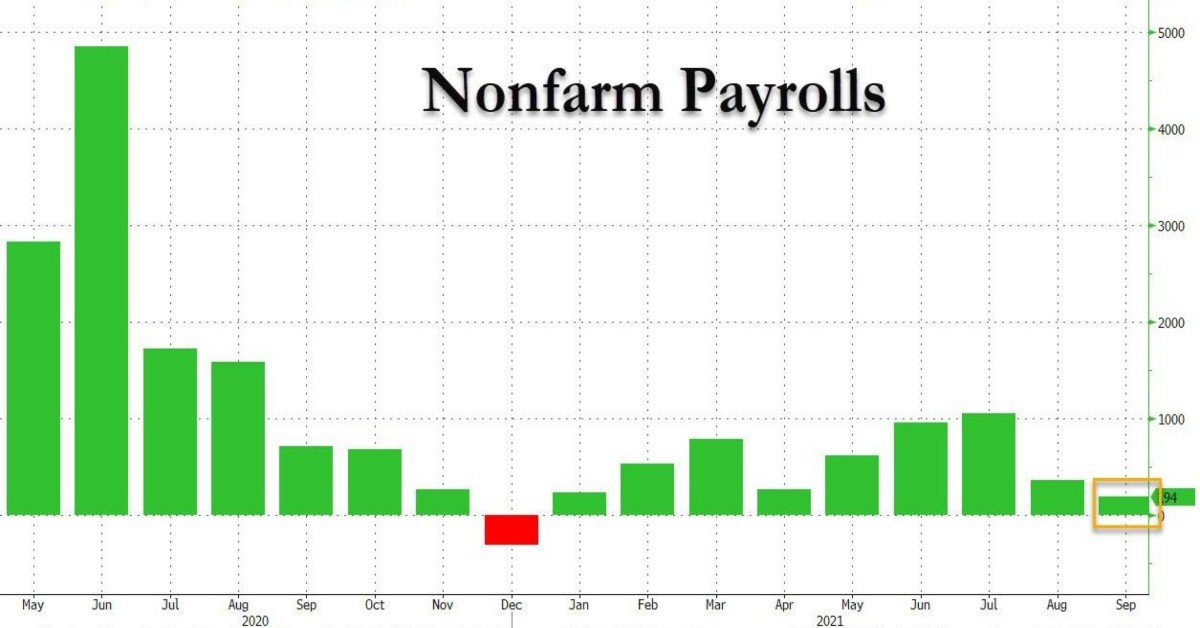

Before analyzing the data, let's take a quick look at what we have there. 194K gain in payrolls in September, compared with 500K expectations, in fact, disappointed the market. However, the unemployment rate fell to 4.8%, and average hourly earnings rose 0.6%.

Recruitment was more than twice less than expected, however, the unemployment rate fell to 4.8%, while the market was expecting 5.1% with 500K jobs. We have two answers for that. First, if we want to be an optimistic person, we can say it is because that we have many self-employed workers who are not necessarily employed anywhere, but on the flip side, we can say the labor force participation rate that also is down to 61.6%, can not be the good enough measure to show the real unemployment rate, so the real unemployment rate can be a bit higher than published numbers.

Another key number that we have to closely watch is the Average Hourly Earnings which increased by 0.6% in September and 4.6% yearly base. This income increasing in line with higher energy prices together will help the inflation to stay higher for a bit longer time, so it can be again encouragement for FED to start tightening its monetary policies.

In short, even if for the second consecutive months we can see the sluggish job growth, I can generally say that overall data are not bad, because the unemployment rate is falling. Also, other increasing factors as I mentioned earlier, are all about moving to better economic conditions, which means still we have many reasons to start tapering in 2021.