The necessity of improving trading skills, discovering new methods and developing reliable strategies is crucial for a successful and profitable trade. Whether you are a well-experienced trader or you are new in the complex world of trading you need good Forex trading strategies to achieve the best trading solutions.

To develop the best trading strategy that will correspond to your knowledge and skills, you should follow certain steps and principles essential in Forex trade. These include how you should plan your trade, what you should avoid and what you should involve in your trade, as well as what you should use for predicting market trend and make reasonable decisions.

Below are mentioned the main rules and principles to develop an effective Forex trading strategy.

How to Develop a Trading Plan?

The well known adage “if you fail to plan, you plan to fail” best suits in Forex trading. The first and important step in developing Forex trading strategies is to have a clear and detailed plan at your hand and stick to it firmly all the time.

You should choose the currency pairs you think are right for you. The proper selection strongly depends on your risk tolerance and whether you have planned a risk averse or a high-risk trading strategy. Some currency pairs are steady and move slowly over longer time frames being less risky, whereas others are more volatile and contain higher level of risk. A riskier strategy can result in high profits but meanwhile it can cause great losses. Based on the currency pair you choose, you can also plan how long to hold positions: minutes, hours, days and months.

Make a Market Analysis

As it is well known, traders can forecast the market trend by making two main types of analyses: technical and fundamental. Whether to perform your trade through technical or fundamental analysis depends on your personality.

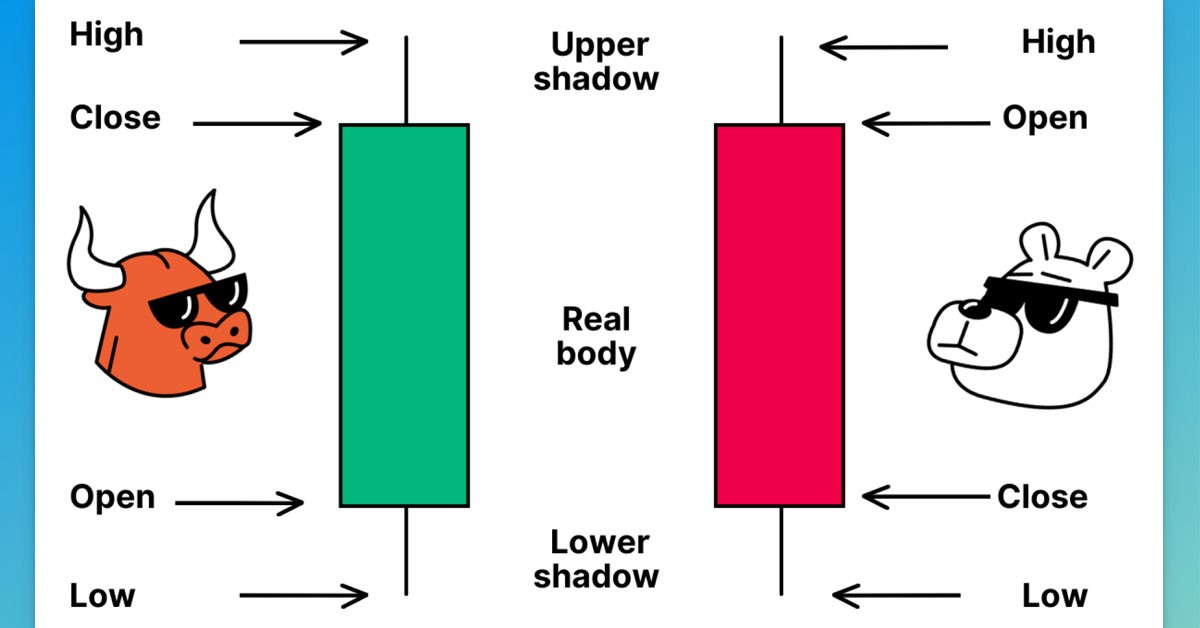

Technical analysts study price movements by taking into account historical data, considering that the market information is already reflected in the given currency trend. They use technical analysis tools, like charts and indicators to identify trends.

Fundamental analysts focus on social, political and economic factors that cause supply and demand. The premise of fundamental analysis is that such forces like inflation, unemployment rate, interest rates and economic growth rates are of great significance while making trading decisions.

Use Stop/Loss Orders

A stop/loss order helps to automatically exit the position when the maximum loss limit is exceeded. By this strategy you protect yourself from great losses. It takes the emotional component out of trading decisions and can be especially useful when you cannot watch your position.

The most successful traders are not the ones who simply open the best positions. They are the ones who are disciplined in their strategy, have a good developed plan and are good at risk management. They do not let emotions affect negatively on the trade. Instead, successful traders set their profit target using stop/loss orders to lock the loss limits.