The nonsense rise in CPI and Retail sales

European stock markets started to gain after a mixed start, and Wall Street closing in Red overnight with ECB holding its ultra-easy monetary policies.

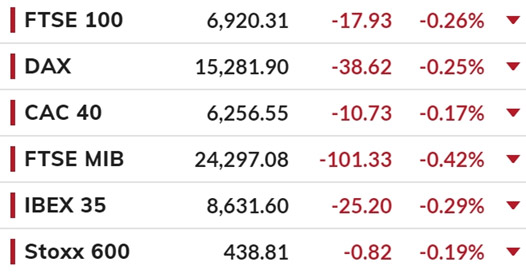

At the time of writing, and while DE100 was trading 0.82% higher, CAC 40 was gaining 0.91%, and GB100 was up by 0.6%, suddenly all started to lose, more than 0.3%.

However, today U.K. published its CPI and Retail Sales data so far, and Manufacturing and Service PMI due to release later with E.Z. PMI data. CPI (YoY) in March raised by 1.7%, while Retail Sales, monthly base and in March, was up by 5.4%, climbing 7.2% on the year, way ahead of expectations. Core Retail sales at the same time rose by 4.9%. Later, both Manufacturing and Service PMI will release. We are waiting to see both above markets` expectations, as vaccination good progress, moved the country into reopening, since last Monday, April 12. and it must help the service sector also to recover faster. The manufacturing section has been improving already.

On the other hand, ECB left its 1.85 trillion-euro ($2.23 trillion) bond-buying program in place at its meeting yesterday, remarked that it would continue purchases at a high pace in the current quarter.

On the COVID front, with the latest wave of Covid-19 infections, this region is ramping up its vaccination program. It is helping the positive market sentiments and improving the economic picture in E.Z.

Another reason for Euro Zone and the U.K. stocks gaining also can be cash flow to this economic area, as President Joe Biden is set to propose almost doubling capital gains tax for the wealthy, prompting speculation they may sell shares before any change is made to lock in a lower rate and move the liquidity to somewhere else, especially for non-U.S. investors.

And finally, on the Earning front, today the German carmaker Daimler (OTC: DDAIF) due to release its earnings report.