Over the last few decades, currency market, commonly known as Foreign Exchange, Forex or FX market, has evolved at such a blinding speed that it has gained an unparalleled amount of interest from all parts of the world. Currency market or simply Forex is considered to be the world’s most famous and the most liquid financial markets which opens up new and fantastic opportunities to everyone. Each day thousands of people from all over the world get involved in currency market trading and enjoy the full benefits of trading the world’s currencies. The main participants of the Forex market are subdivided into 4 groups. The first and the most powerful participants of the market are the major banks, bank associations (JP Morgan, Citigroup, etc.) and a few central banks (the Bank of England, the Federal Reserve of the US, etc.). The second group of participants includes insurance, investment, large corporations, medium-sized banks and pension funds. The third group is considered to be the financial companies and the last layer belongs to individuals. Foreign Exchange market is really very attractive and fascinating, but it’s worth mentioning that it is also very unpredictable and involves a high level of risk which should be carefully taken into account. Hence, before taking up currency market trading, each trader should possess the following skills for being able to overcome all the possible obstacles while trading and resist the market changes: determination, dedication, confidence, discipline, logic, self-control, flexibility, patience and what the most important is realism.

Actually, with an average daily turnover of $5 trillion, Foreign Exchange is the largest currency market across the world which operates 24 hours a day, except the weekends. As it is known, the rate of the currencies tends to change constantly depending upon various factors like economy, politics, etc. and it is these very fluctuations which give the opportunity of making money. In simple terms, currency market trading is all about speculating on the price of one currency against another one.

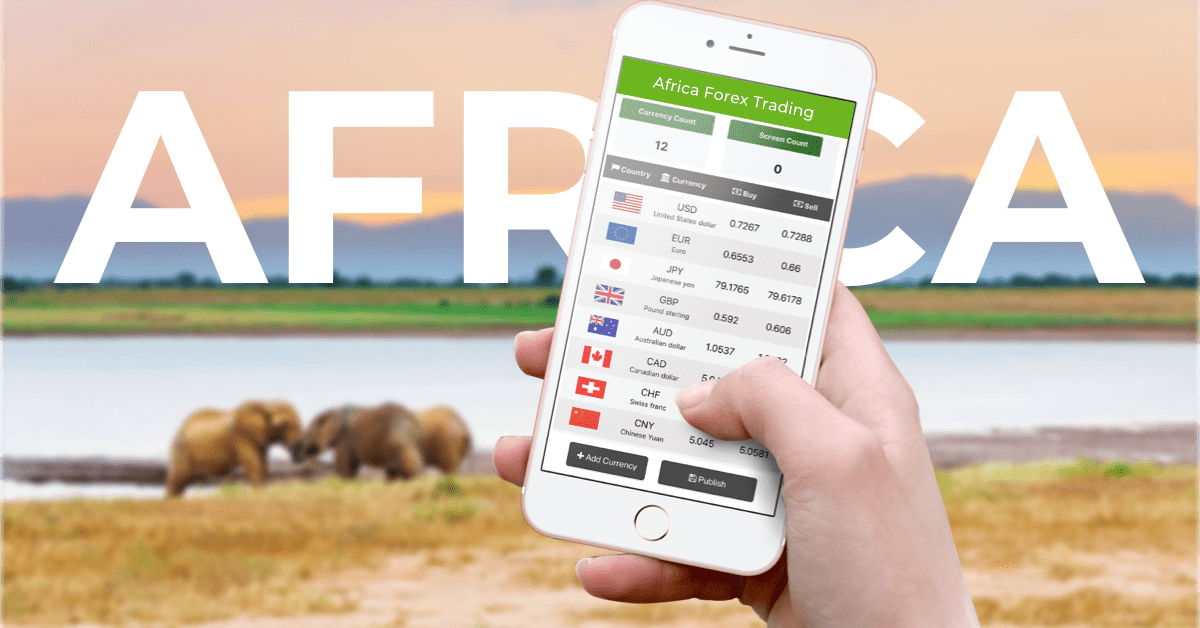

As was mentioned above, currencies are the main objects of trading in the Forex market and respectively they are divided into the following three groups:

- Major - the currencies which are most actively traded in the market. USD, EUR, AUD, CAD, GBP, CHF, and JPY are the major currencies.

- Minor - all the rest currencies are supposed to be the Minor currencies.

- Exotic - the currencies which are less actively traded in the market and which are not so popular among traders are considered to be the Exotic currencies. Here are some examples of exotic pairs: USD/RUB (US dollar/Russian Ruble), EUR/CZK (Euro/ Czech Koruna), EUR/PLN (Euro/ Polish Zloty), USD/DKK (US dollar/Danish krone), etc.

With the emergence of a new technology PCI (Personal Composite Instruments) developed by IFC Markets, it has become possible to create and trade your own synthetic pairs alongside the traditional ones. PCI technology is a real innovation in the financial world which has taken currency market trading and trading in general to a completely new level.

Actually, the Foreign Exchange market will always be one of the most demanded and the most compelling financial markets in the world, because there will always be someone who is willing to exchange the currency of one country for another one.